Discover the promising prospects and growth opportunities awaiting in Sri Lanka’s dynamic financial services industry, as the country establishes itself as a regional financial hub.

The Landscape of Financial Jobs

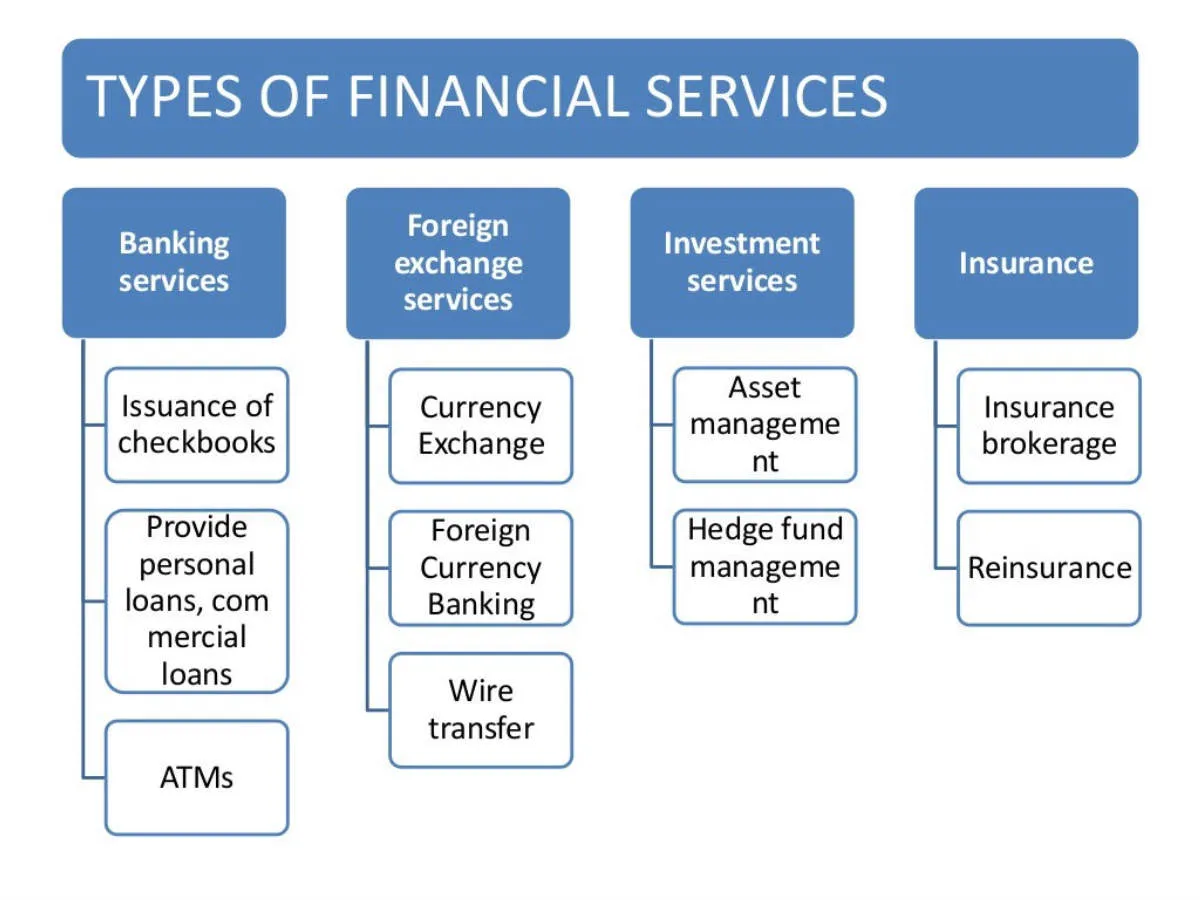

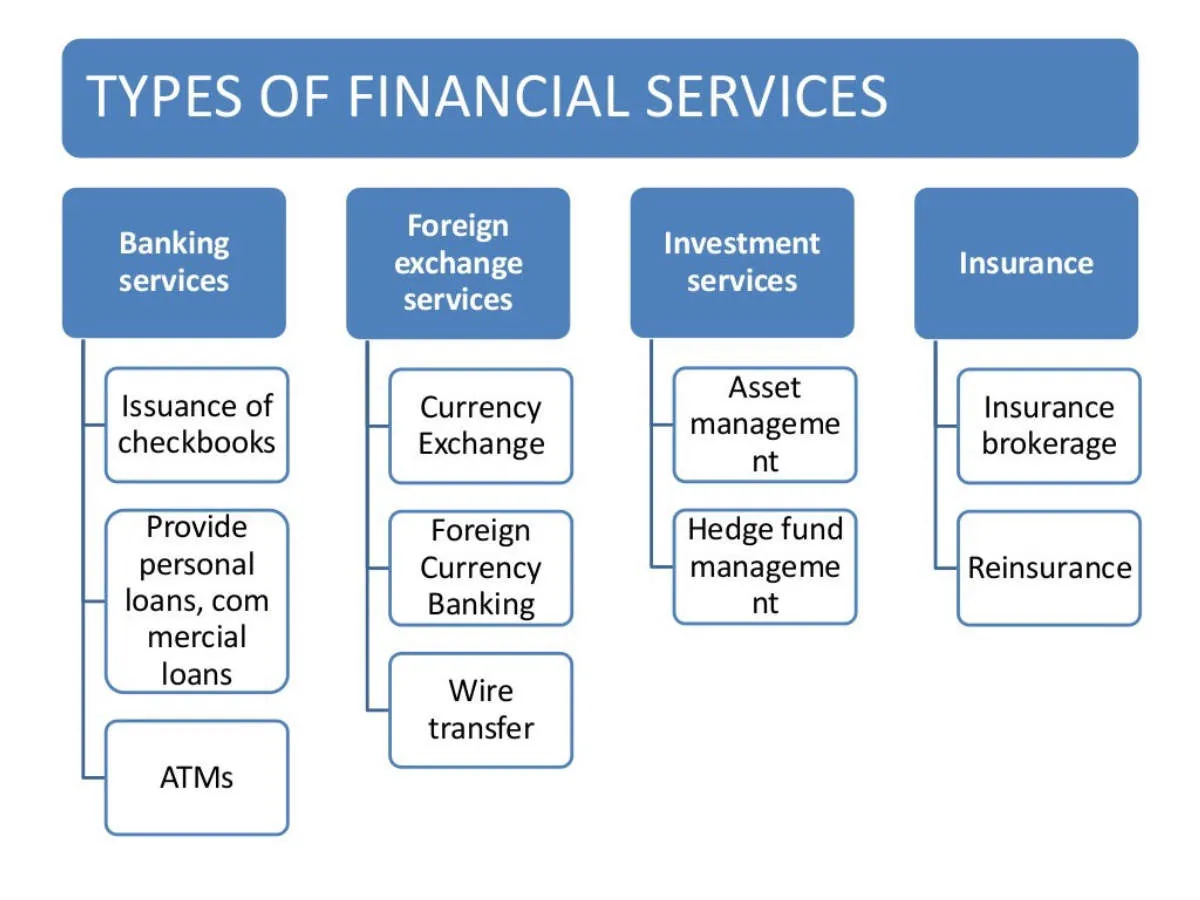

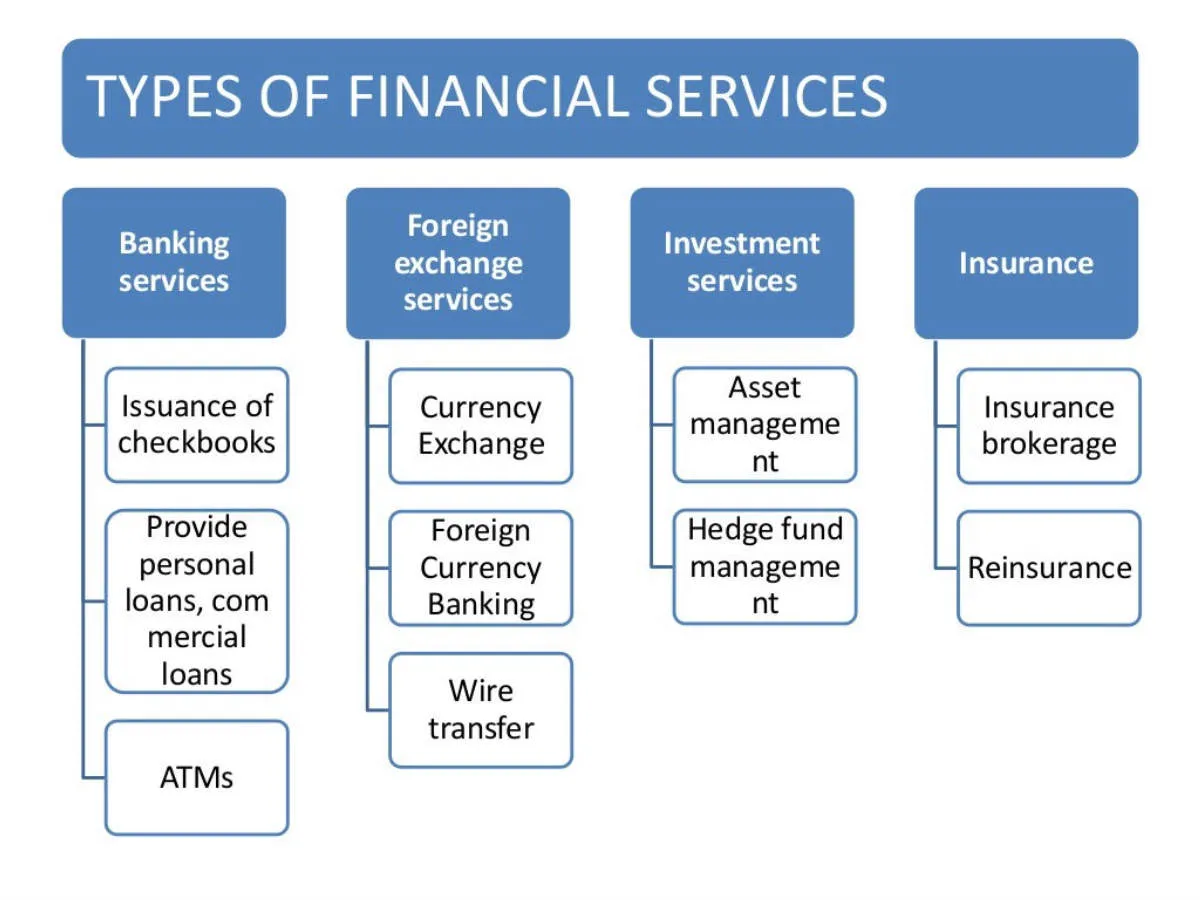

Within Sri Lanka’s thriving Financial Services Industry, an array of diverse job opportunities awaits skilled professionals seeking dynamic career paths. The landscape of financial jobs in the country encompasses a wide range of roles, from traditional banking positions to specialized roles in fintech and insurance.

1. Banking Sector: The banking sector in Sri Lanka offers a plethora of job opportunities, including positions in retail banking, corporate banking, investment banking, and treasury services. Banking professionals can find roles in areas such as customer relations, risk management, and financial analysis.

2. Fintech Innovations: With the rise of financial technology, the demand for professionals with expertise in fintech is on the rise. Sri Lanka’s financial services industry embraces digital transformation, creating opportunities in areas such as blockchain technology, mobile payments, and data analytics.

3. Insurance Industry: The insurance sector in Sri Lanka provides a range of job opportunities for individuals interested in actuarial science, underwriting, claims management, and insurance sales. Professionals in this sector play a crucial role in managing risks and promoting financial security for individuals and businesses.

4. Regulatory Compliance: As the financial services industry evolves, the need for professionals well-versed in regulatory compliance and risk management increases. Careers in compliance ensure that financial institutions adhere to legal standards and industry best practices, safeguarding the stability and integrity of the financial system.

5. Wealth Management: Jobs in wealth management cater to individuals seeking to work closely with clients to enhance their financial portfolios. Wealth managers provide personalized financial advice, investment strategies, and asset management services to help clients achieve their financial goals.

High-Demand Roles in Finance

When looking at the financial services industry in Sri Lanka, certain roles stand out as particularly in demand due to the evolving landscape and market dynamics. Organizations operating in this sector are actively seeking professionals to fill key positions that drive growth and innovation.

1. Financial Analysts

Financial analysts play a crucial role in interpreting data, assessing performance, and providing insights to support strategic decision-making. Their ability to analyze trends and forecast market conditions is essential for businesses to stay competitive.

2. Risk Managers

Risk managers are vital in guiding companies through potential threats and uncertainties. With the increasing complexity of financial markets, professionals in this role are responsible for developing risk mitigation strategies and ensuring compliance with regulations.

3. Investment Bankers

Investment bankers facilitate capital raising, mergers, and acquisitions, driving economic growth in the financial services sector. Their expertise in structuring deals and assessing market opportunities makes them valuable assets for both local and international transactions.

4. Compliance Officers

Compliance officers play a critical role in upholding ethical standards and regulatory requirements within financial institutions. As regulations continue to evolve, professionals in this field are essential for ensuring transparency and integrity in business operations.

5. Fintech Specialists

The rise of financial technology has created a demand for fintech specialists who can drive digital innovation and enhance customer experience. Professionals with expertise in areas such as blockchain, artificial intelligence, and digital payments are highly sought after in today’s financial services industry.

Skills and Qualifications Needed

For individuals seeking opportunities in Sri Lanka’s thriving Financial Services Industry, there are specific skills and qualifications that are highly valued by employers in this sector.

1. Financial Acumen: A strong grasp of financial principles and practices is essential. Candidates should have a solid understanding of financial statements, risk management, and investment strategies.

2. Analytical Skills: The ability to analyze complex data, identify trends, and make informed decisions is crucial in the financial services sector. Employers look for individuals who can think critically and solve problems effectively.

3. Communication Skills: Effective communication is key in this industry as professionals need to interact with clients, team members, and stakeholders. Strong verbal and written communication skills are essential.

4. Technical Proficiency: Proficiency in financial software, tools, and platforms is essential. Candidates should be comfortable using spreadsheets, financial modeling software, and other relevant technologies.

5. Regulatory Knowledge: Awareness of financial regulations and compliance is crucial. Individuals must stay updated on industry regulations and demonstrate a commitment to ethical practices.

6. Qualifications: While having a degree in finance, accounting, economics, or a related field is advantageous, professional certifications such as CFA (Chartered Financial Analyst) or ACCA (Association of Chartered Certified Accountants) can enhance one’s prospects in the industry.

Searching for Financial Positions

When looking for job opportunities in Sri Lanka’s booming financial services industry, individuals searching for financial positions need to take into consideration various factors to enhance their chances of landing a desired role. With the industry experiencing growth and diversification, the demand for skilled professionals in finance-related roles is on the rise.

Networking is a key aspect for those seeking financial positions in Sri Lanka. Building connections with professionals in the industry through events, seminars, and online platforms can provide valuable insights and potential job leads. Establishing a strong network can give individuals a competitive edge in the job market.

Continuous Learning is crucial in the financial services sector. Keeping up-to-date with industry trends, regulations, and new technologies is essential for candidates looking to secure financial positions. Pursuing certifications or advanced degrees can demonstrate a commitment to professional development.

Utilizing Online Job Portals is another effective way to search for financial positions in Sri Lanka. Websites dedicated to job postings in the financial services industry offer a wide range of opportunities for job seekers. Tailoring resumes and cover letters to match specific job requirements can help candidates stand out to potential employers.

Moreover, Internship Opportunities can serve as a stepping stone for individuals looking to start a career in finance in Sri Lanka. Internships provide hands-on experience, industry exposure, and networking opportunities that can lead to full-time financial positions in the future.

In conclusion, searching for financial positions in Sri Lanka’s dynamic financial services industry requires a proactive approach, continuous learning, networking, and leveraging various resources to increase the likelihood of securing desired roles.

Finance Interview Preparation

Preparing for a finance interview in Sri Lanka’s Financial Services Industry requires careful attention to detail and thorough research. Here are some key tips to help you ace your finance interview:

1. Understand the Company

Before your interview, research the company you’re applying to. Understand their values, mission, and services they offer. This will demonstrate your interest and show that you are prepared.

2. Know the Industry

Stay informed about the financial services industry in Sri Lanka. Be aware of current trends, challenges, and opportunities. This knowledge will showcase your expertise and passion for the field.

3. Review Common Finance Questions

Practice answering common finance interview questions, such as explaining financial concepts, discussing your previous experience, and addressing challenges you’ve overcome in the workplace.

4. Showcase Your Skills

Highlight your technical skills, such as proficiency in financial software, data analysis tools, and reporting systems. Provide concrete examples of how you have used these skills effectively.

5. Prepare for Behavioral Questions

Be ready to answer behavioral questions that assess your problem-solving abilities, teamwork skills, and decision-making processes. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

6. Dress and Behave Professionally

On the day of your interview, dress in professional attire and maintain a positive attitude. Arrive on time, greet your interviewers politely, and exude confidence in your abilities.

By following these tips and adequately preparing for your finance interview, you can position yourself as a strong candidate in Sri Lanka’s Financial Services Industry.

Navigating Sri Lanka’s Financial Sector

When looking to explore opportunities in Sri Lanka’s financial services industry, it is crucial to understand how to navigate the dynamic landscape of the country’s financial sector. Here are some key strategies and insights to help you navigate effectively:

Understanding the Regulatory Environment

One of the first steps in navigating Sri Lanka’s financial sector is to familiarize yourself with the regulatory framework governing the industry. The Central Bank of Sri Lanka plays a significant role in regulating financial institutions and supervising the sector to ensure stability and compliance with policies.

Identifying Growth Areas

It is essential to identify the growth areas within Sri Lanka’s financial sector. This could include sectors such as banking, insurance, capital markets, and fintech, which are experiencing rapid advancements and opportunities for investment and innovation.

Building Strategic Partnerships

Establishing strategic partnerships with local financial institutions, industry associations, and government bodies can provide valuable insights and access to resources that can help navigate the complexities of the financial sector in Sri Lanka.

Embracing Technological Advancements

The digital transformation of the financial services industry is rapidly evolving in Sri Lanka. Embracing technological advancements such as mobile banking, digital payments, and blockchain can help streamline operations and reach a wider customer base.

Adapting to Cultural Nuances

Understanding and respecting the cultural nuances of doing business in Sri Lanka is essential for successful navigation of the financial sector. Building trust, fostering relationships, and being aware of local customs can facilitate smoother interactions and transactions.

By employing these strategies and staying informed about industry trends and developments, individuals and organizations can navigate Sri Lanka’s financial sector effectively and capitalize on the opportunities it presents.

Conclusion

In conclusion, Sri Lanka offers promising opportunities for growth and investment in its financial services sector.